Are you thinking of becoming an authorized person of Angel Broking (also known as an Angel Broking AP)?

If yes, then it becomes essential for you to know about the eligibility criteria, charges and registration process in detail. Let’s move ahead together on the knowledgeable journey to discuss the outlook on the same.

What is Angel Broking AP?

According to NSE, an authorized person is the one who is not connected to the stock exchange as a trading member but he is the one who takes the action as an agent on the behalf of the trading member or else he advises or assists the investors to deal in the securities using such trading members.

An authorized person can be a partnership firm, an individual, LLP, or the corporate body.

Note: The conversion of the sub-broker to authorized person was asked by SEBI on August 3rd, 2018.

After the conversion, there were no changes that were found in the operation as well as roles that are to be performed by the authorized person with respect to the sub-broker.

You can become an AP with Angel Broking with your desired preference and choosing one model out of two. The models are listed below:

- Part-Time AP Model

- Full-Time AP Model

Now, let’s understand the models in detail as the next segments will cover the elements depending on them.

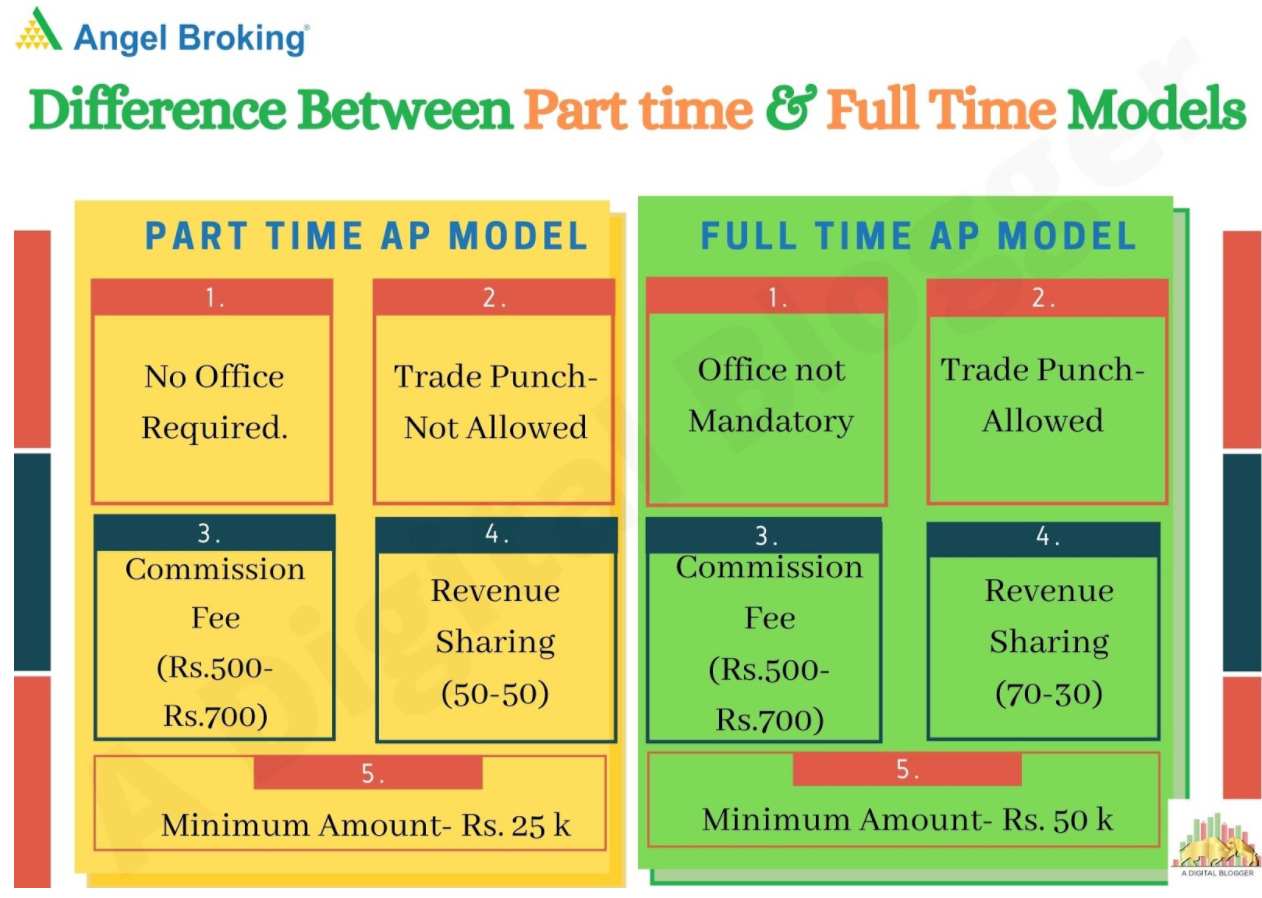

To get a gist, gather the information from the following infographic:

To get detailed information about the above information, check the following information on the Part-Time AP Model and Full-Time AP Model.

- Part-Time AP Model

- In this model, there is no need to set up the office.

- The trade punch can not be taken into consideration or existence.

- The commission fee in the part-time model varies from Rs. 500- Rs. 700 and is decided on the basis of the accounts that are being opened by the AP.

- Here, the revenue sharing remains in the proportion of 50-50.

- The minimum amount that is to be paid to become AP is Rs. 25000.

- Full-Time AP Model

- Here, setting up the office is not mandatory but can be established if found necessary or needed.

- In this model of AP, the trade punch can be done on the behalf of the customers.

- Taking commission into consideration, it is important to mention that it varies the same as that of the part-time model, i.e. from Rs. 500- Rs. 700.

- In the full-time model, the revenue sharing is based on the proportion of 70-30.

- To become an AP with the firm, the minimum amount that is to be paid is Rs. 50,000.

Note: The “Trade Punch” used in the part-time and full-time AP model, defines that the AP can proceed with and take the trading actions on the behalf of the customers.

As discussed above that the individual can connect with Angel Broking as an Authorised person according to his suitability and conditions.

Angel Broking AP Eligibility

If applying for any job, courses, and accounts, there are some eligibility criteria that are needed to be fulfilled and to become a suitable applicant.

The same occurs in the case of becoming an Authorised Person of Angel Broking. To know about the Angel Broking AP eligibility, refer to the following information that covers the basic suitability for becoming an AP.

- The AP should be more than 18 years.

- He should carry the graduation degree.

- Should have 2 years experience in the share market.

To have a detailed knowledge of the eligibility criteria for individuals refer to the following information.

- The applicant should be an Indian citizen.

- The person can become an AP if he is above 18 years.

- The applicant should not be involved in the fraudulent activity.

- Reputation and character matter to become an AP with Angel Broking.

- The Authorized Person must also possess the infrastructure required for an appropriate exercise of actions on behalf of a Trading Member, such as proper office space, staff, and equipment.

Apart from this, to have a piece of knowledge of the eligibility criteria for a partnership firm, LLP, or corporate firm, refer to the following information.

- The directors and partners are required to follow the individual’s eligibility criteria, according to the situation.

- The clause that permits a person to deal in the securities business should be contained by the object clause of the Partnership Deed and Memorandum of Association.

- The Authorised Person must also ensure the required facilities, such as sufficient office space, equipment, and services, to carry out the Trading Member’s operations properly.

These eligibility criteria make an individual a suitable person for becoming an AP. In case, the above-mentioned criteria are not fulfilled, the possibility of becoming an AP with Angel Broking will be decreased.

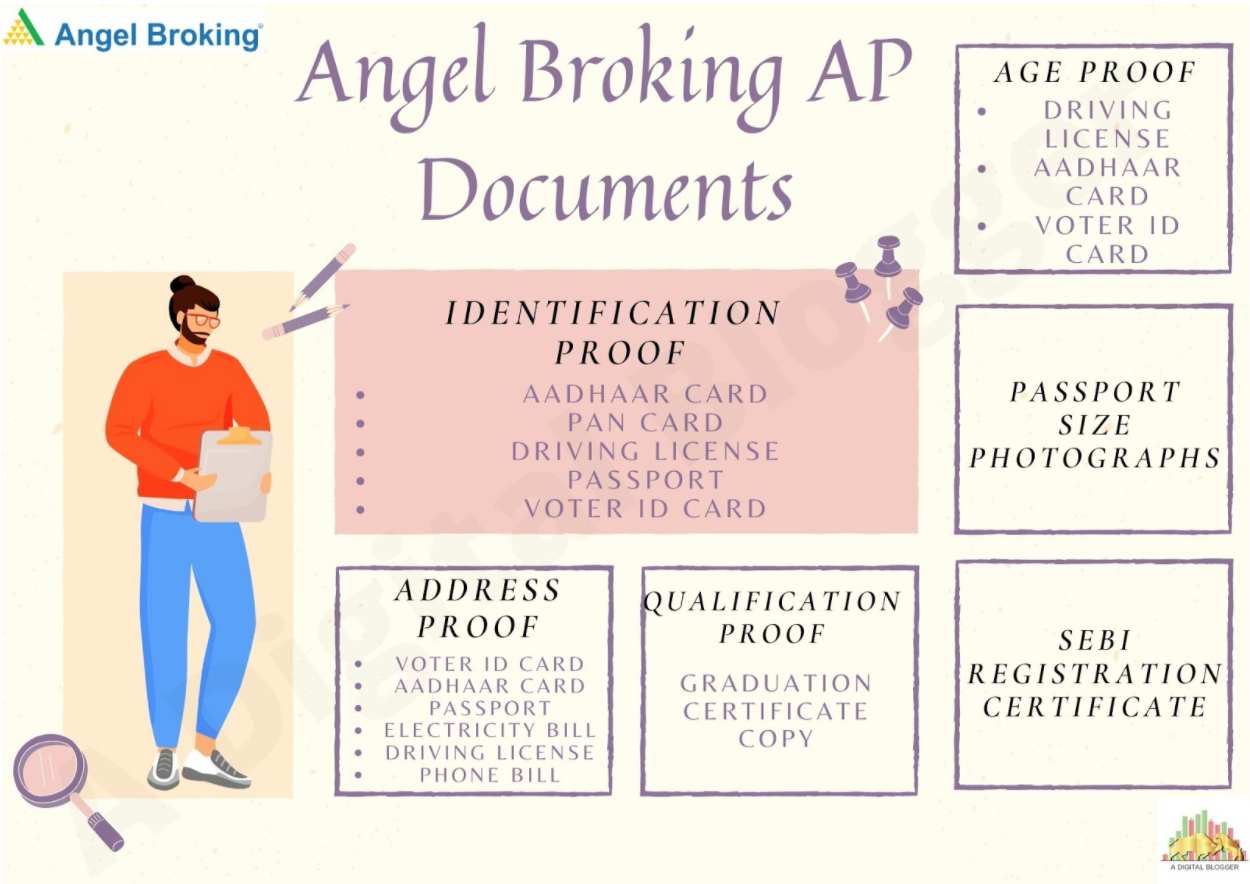

Angel Broking AP Documents

For connecting to the authorized firm, it is necessary to submit some documents as proofs. To have a clear understanding of the documents, refer to the following infographic:

Apart from the infographic, here is the information about the documents that are required for being an AP with Angel Broking.

- Identification Proof

- Aadhar Card

- PAN Card

- Voter Card

- Driving License

- Passport

- Address Proof

- Aadhar Card

- Voter Card

- Passport

- Electricity Bill

- Driving License

- Phone Bill

- Qualification Proof

- Copy of Graduation certificate

- Age Proof

- Driving License

- Aadhar Card

- Voter Card

- Passport size photographs

- SEBI registration certificate

The documents are necessary to be submitted to the broker, i.e. Angel Broking to start with the process of becoming the AP.

Angel Broking AP Charges

For becoming the Authorised Person of the Angel Broking, there are some charges that are to be kept in mind before connecting to the firm. The charges are mentioned in the following segments as:

- Angel Broking AP Initial Cost

- Angel Broking AP Revenue Sharing

To know more about the charges in detail, stay tuned to the segments.

Angel Broking AP Initial Cost

Now, you might be interested to know the charges that will be charged on you for becoming the AP with Angel broking. The initial cost for becoming an AP is negotiable according to the person’s preference.

It is necessary to pay Rs. 50,000 as the initial cost for becoming the AP of Angel Broking.

However, there is another option to get around this condition. Here, an AP can deposit Rs. 10,000 as the initial cost (out of the total 50k) and for the rest, he/she can buy shares of that value and pledge those shares with Angel Broking.

This way, you do not end up paying Angel broking the complete 50k and become their Authorized person too.

Note: If the AP is paying Rs. 50,000 as an initial cost, he will not be given access to the terminal. Whereas, if the AP is paying Rs. 1 Lakh as the initial cost, access to the terminal will be provided to the AP.

The AP should have to pay the security deposit of Rs. 50, 000 to Rs. 1 lakh as mentioned above, on the basis of which access to the terminal will be given.

Remember, the charges for the AP model with Angel Broking could be seen as the same as Angel Broking Sub Broker charges. It’d be better you do a thorough review of both the models before making a choice.

Angel Broking AP Revenue Sharing

As discussed above the part-time and full-time AP models, now, let’s see how does the revenue sharing actually work under these two mentioned models.

While being the AP of the Angel Broking, especially in the part-time model, the revenue sharing will be 50-50, which means that the 50% revenue will be of the AP and 50% will belong to Angel Broking.

Whereas, in the full-time model, the revenue sharing will be 70-30, where 70% will be of the AP, and 30% will belong to the company, i.e., Angel Broking.

The commission of the AP will vary depending on the number of accounts opened. The amount range starts from Rs. 500 and varies till Rs. 700 in both models, i.e., part-time and full-time.

Angel Broking AP Registration

Thinking of how to get registered as Angel Broking AP?

It is simple, just follow the steps below and start working as an Authorized Person with the leading brokerage firm, Angel Broking.

- Submit the essential documents and three canceled cheques.

- Along with that, it is required to submit the education proof of 10th standard.

- The person has to make the IPV (In-Person Verification) video where he has to introduce himself along with the approval of becoming the AP of the Angel Broking.

Note: The person has to record three videos by showing the Aadhar Card, PAN Card, and the self authorization respectively. The video should be of 2-3 minutes. - After completing the above-mentioned procedures, now, he is required to pay the fees for becoming the Authorized Person.

- Later, he has to sign the agreement that will be with the broker, i.e. Angel Broking. The signature can be done as eSign or in person.

- It is very important to note that the applicant will have to pay Rs.2360 for connecting with NSE or BSE.

For example: If Ayushman wants to become an AP of Angel Broking and has completed the steps till 5, now to get started he has to open an account with an exchange for which he needs to pay ₹2360 to each exchange i.e. NSE and BSE.

With this, he gets an equity account, but for commodity and currency, he needs to pay additional fees of ₹2360 for each trading segment.

- The revenue sharing depends on the different plans available in Angel Broking. Simply, different plans lead to different revenue sharing.

Get yourself registered with the firm as Angel Broking AP and reap the benefits.

This needs to be understood that the steps to become a sub-broker are slightly different. If you’d like to know more, check this review on how to become sub broker of Angel Broking here.

Conclusion

Being an Angel Broking AP offers you many benefits. Just make sure you meet the eligibility criteria before applying and keep all the documents handy.

The firm also gives you the option to perform your job part-time.

To get started fill the form below: